What Is The Cheapest Way To Buy A Foreclosed Home: Specialist Tips and Tricks

Wiki Article

A Comprehensive Guide to Exploring the World of Foreclosed Residences in Today's Real Estate Market

Are you interested in diving right into the world of confiscated homes? Look no more! This thorough guide will stroll you with the entire process, from comprehending exactly how foreclosures function to reviewing the condition of homes. With financing alternatives and experienced ideas on buying and navigating the bidding process, you'll be well-equipped to make a clever investment in today's realty market. Let's start!Understanding the Foreclosure Refine

When a homeowner falls short to make home mortgage payments, the lending institution has the right to confiscate on the property. The repossession process typically starts with the lender sending a notification of default to the home owner.If the homeowner does not bring the home mortgage current, the loan provider will certainly launch the foreclosure proceedings. This involves submitting a lawsuit versus the home owner to seize the residential property. The homeowner will after that get a notification of repossession, mentioning the date of the foreclosure sale.

On the scheduled sale day, the residential property is auctioned off to the highest possible prospective buyer. It becomes known as a REO (Genuine Estate Owned) property and is possessed by the lender if the residential property does not offer at public auction. At this moment, the lending institution can detail the residential or commercial property to buy on the market.

Recognizing the foreclosure procedure is critical when thinking about buying a confiscated home. It is essential to be knowledgeable about the potential risks and difficulties that might develop. Nevertheless, with careful study and guidance, acquiring a seized residential property can provide a special chance to find a large amount in today's realty market.

Researching Confiscated Properties

When you're looking into confiscated residential or commercial properties, it is essential to gather as much details as feasible about the residential or commercial property's background and existing problem. Start by getting in touch with the bank or loan provider that has the residential property. They can offer you with information regarding the repossession procedure and any arrearages or liens on the residential property. It's likewise a good idea to check out the court and look public documents for details about the home's ownership history, past sales, and any kind of lawful problems. In addition, you need to perform a physical examination of the property. Search for indicators of damage or neglect, such as busted home windows or thick lawns, as these can impact the residential or commercial property's worth and your possible investment. Consider working with a specialist home inspector to extensively evaluate the property's condition and identify any type of prospective concerns. Ultimately, research the neighborhood market to figure out the property's worth. Consider comparable sales in the area and think about variables such as place, amenities, and market demand. By gathering as much info as possible, you can make an educated choice when acquiring a seized residential or commercial property.Financing Options for Getting Foreclosed Residences

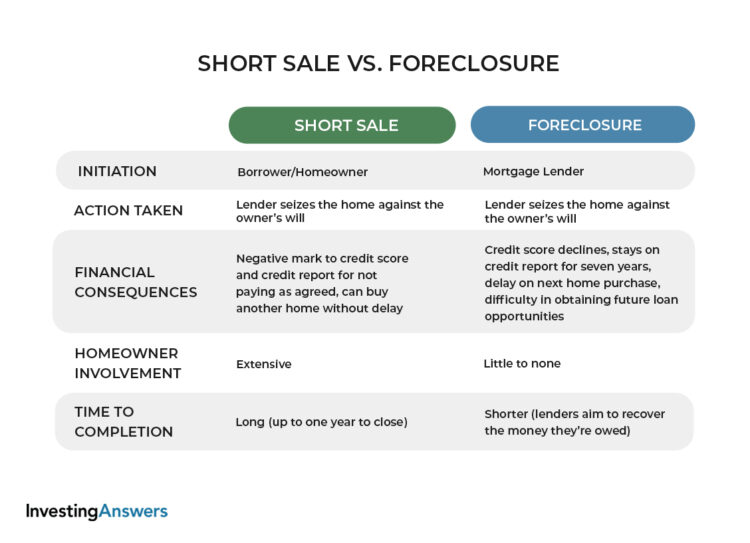

If you're seeking to purchase a confiscated home, there are numerous funding choices readily available to aid you secure the essential funds. One alternative is to get a traditional mortgage from a financial institution or lending institution. This includes applying for a loan and going through the conventional approval procedure. Some financial institutions may have stricter requirements for confiscated homes, so it's vital to do your research study and locate a lending institution who specializes in this kind of financing. One more option is to take into consideration a government-backed financing, such as an FHA lending or a VA car loan. These lendings commonly have more versatile needs and reduced deposit choices, making them accessible to a larger variety of customers. Furthermore, you might want to explore the possibility of an improvement car loan, which can help cover the costs of fixing and redesigning a foreclosed property. This sort of financing permits you to acquire the home and include the improvement costs in your mortgage. Before choosing, it's important to contrast the various funding choices readily available and difference between short sale and foreclosure select the one that ideal suits your economic circumstance and objectives.

Assessing the Problem of Confiscated Residence

Take a close check out the overall problem of the seized homes you're taking into consideration to guarantee you recognize any required repair work or improvements. When it comes to purchasing a seized home, it's vital to completely evaluate its condition prior to choosing. Beginning by carrying out an extensive examination of the property. Look for any type of indicators of damage, such as water leakages, architectural concerns, or electrical problems. Inspect the roofing system, foundation, pipes, and electric systems to ensure they remain in good functioning order. Do not fail to remember to take a look at the interior as well, consisting of the floorings, walls, and home appliances. It's necessary to establish the level of restorations or repair work required and element in the costs connected with them. Working with a professional assessor can provide you with a detailed report, assisting you make a notified decision. foreclosed homes for sale cheap. In addition, consider connecting to professionals or professionals that can approximate the cost of fixings. Keep in mind to consist of these costs in your budget plan and work out the purchase price as necessary. By examining the condition of foreclosed residential properties, you can stay clear of unanticipated surprises and make an educated financial investment choice.Browsing the Bidding Process and Buying Refine

Acquiring and navigating the bidding process procedure can be difficult, but with careful research study and prep work, you can raise your possibilities of securing a seized building. The initial step is to comprehend the public auction procedure. Locate out when and where the auction will certainly occur and familiarize on your own with the regulations and guidelines. Ensure you have the necessary funds offered, as the majority of public auctions need immediate settlement. Once you prepare, attend the public auction and be prepared to take on various other prospective customers. Establish a budget beforehand and adhere to it, as it's easy to get caught up in the enjoyment and overspend. Congratulations if you're the greatest bidder! If you're not successful, do not be prevented. There are various other avenues to discover. Consider acquiring a bank-owned property straight from the loan provider or working with a genuine estate agent that concentrates on foreclosures. These specialists can direct you via the acquiring procedure and help you locate the most effective deal. Remember, patience and perseverance are crucial when it comes to buying a seized property. By doing your homework and remaining concentrated, you can locate an excellent chance in today's genuine estate market.Conclusion

/Short-Sale-by-Owner-56a494135f9b58b7d0d7a5bc.jpg)

If the residential or commercial property does not sell at public auction, it becomes well-known as a REO (Genuine Estate Owned) building and is possessed by the loan provider. With mindful research study and guidance, getting a foreclosed residential or commercial property can supply a special opportunity to discover a fantastic bargain in today's actual estate market.

Navigating the bidding and getting procedure can be challenging, however with mindful research and preparation, you can raise your possibilities of safeguarding a foreclosed building.

Report this wiki page